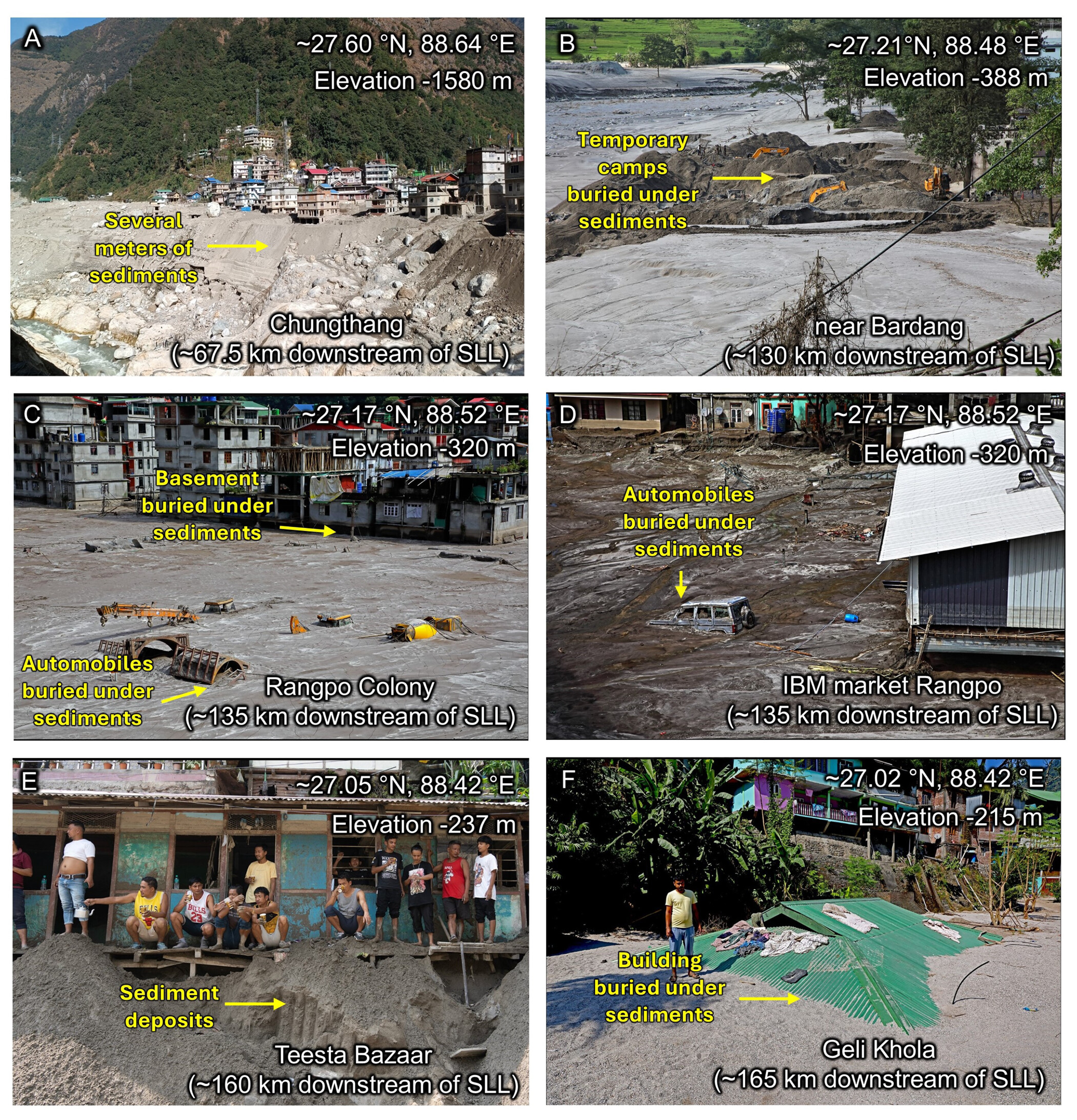

Field evidence of sediment aggradation. (A to F) Photographs taken along the Teesta River show the aggradation of the sediments transported by the flood cascade and its impact. Latitude, longitude, and elevation (in m a.s.l) are at top right; locality name and distance from SLL are at bottom right. Photo credits: Praful Rao (study co-author).

A Disaster Unfolds

Imagine waking up in the middle of the night to a roaring wall of water crashing through your town. That’s what happened in Sikkim, India, on October 3, 2023. A glacial lake high in the Himalayas burst suddenly, sending a flood of 50 million cubic meters of water rushing downstream. Villages were washed away, bridges collapsed, and a massive hydropower dam was completely destroyed.

The flood traveled 385 kilometers, even reaching parts of Bangladesh. This was no ordinary flood—it was a Glacial Lake Outburst Flood (GLOF), a type of disaster that’s becoming more frequent as the planet warms.

What Caused the Flood?

At the heart of this disaster was South Lhonak Lake, one of the fastest-growing glacial lakes in the Himalayas. Scientists have been watching it for years, warning that its natural dam—made of ice and rock—was getting weaker.

Then, the worst happened:

- A 14.7-million cubic meter chunk of frozen land collapsed into the lake.

- This triggered a 20-meter-high wave—as tall as a six-story building.

- The wave smashed through the natural dam, sending a torrent of water and debris barreling down the valley.

Think of it like a bathtub overflowing, except instead of a few gallons of water, it was millions of tons rushing out all at once.

The Impact: Lives, Land, and Infrastructure Lost

The destruction was swift and brutal:

- 55 people lost their lives, and 74 are still missing.

- More than 7,000 people were displaced, their homes and villages washed away.

- 31 bridges, 25,900 buildings, and 276 square kilometers of farmland were destroyed.

- The flood carried away 270 million cubic meters of sediment—enough to fill 100,000 Olympic-sized swimming pools.

Entire communities were left without power, food, or clean water, and the road to recovery is long.

The Role of Climate Change

So, why did this happen? The simple answer: climate change.

- The South Lhonak Glacier has been melting faster than ever, losing 0.58 meters of ice every year.

- The lake it feeds has grown dramatically in the past few decades.

- Warming permafrost (frozen soil) is making mountain slopes unstable, increasing the risk of landslides and dam failures.

This isn’t just a Sikkim problem—glaciers around the world are melting at record speeds, putting millions of people at risk.

Could This Happen Again?

Unfortunately, yes. Scientists warn that South Lhonak Lake is still unstable.

- The natural dam is eroding, making another flood likely.

- Riverbanks weakened by the last flood could collapse, leading to more destruction.

- Extreme rainfall—which is increasing due to climate change—could trigger another disaster.

And it’s not just Sikkim—other glacier-fed lakes in the Himalayas, the Andes, and even North America are showing similar warning signs.

Why This Matters

If you think this is just a distant problem, think again. The same climate forces that caused the Sikkim flood are also affecting other mountainous regions worldwide.

Melting Glaciers Are a Global Issue

Glaciers are retreating in Alaska, the Rocky Mountains, and the Pacific Northwest. As ice melts at a faster rate, more glacial lakes are forming, increasing the chances of floods like the one in Sikkim. If we don’t prepare, communities in mountainous regions of the U.S. could face similar disasters.

U.S. Disasters Are Increasing

The 2022 Yellowstone flood destroyed roads, bridges, and homes, forcing many residents to evacuate. In California, record-breaking storms and floods are becoming more frequent, causing billions in damage. Extreme weather events—whether floods, hurricanes, or wildfires—are getting stronger, deadlier, and harder to predict.

Our Infrastructure Is at Risk

Just like the Teesta-III dam in Sikkim collapsed, many worldwide dams, roads, and power plants are vulnerable to extreme weather. Many of these structures were built decades ago and weren’t designed to handle the kinds of disasters we’re seeing today.

We Can Learn

By taking action now, the U.S. can prevent similar disasters:

- Invest in early warning systems—monitor unstable lakes and glaciers.

- Upgrade infrastructure—build flood-resistant bridges and roads.

- Plan for extreme weather—ensure communities are prepared for disasters.

Preventing Another Tragedy

While we can’t stop glaciers from melting overnight, we can take steps to reduce the damage.

Early Warning Systems (EWS)

Science and technology give us powerful tools to predict disasters before they happen. Governments and scientists must monitor unstable lakes and glaciers using satellites, sensors, and AI-driven models. These systems can detect early signs of danger, giving communities valuable time to evacuate before disaster strikes. Investing in real-time alerts and community education could save thousands of lives.

Building Stronger Infrastructure

We need to rethink how we design bridges, roads, and power plants. Structures built decades ago were not designed to handle the kinds of extreme weather we’re facing today. Engineers and policymakers must ensure that new infrastructure is flood-resistant and that existing structures are reinforced to withstand future disasters. This kind of investment is expensive, but the cost of doing nothing is far greater.

Preparing for Disasters

Education and preparation can mean the difference between life and death. Governments and communities must train people on emergency evacuation plans and improve international cooperation to respond to climate disasters. Since floods and other extreme weather events are increasing, being prepared is no longer optional—it’s essential.

Addressing Climate Change at Its Root

At the core of these disasters is a warming planet. To slow down glacial melting, we need to cut greenhouse gas emissions. Governments, businesses, and individuals can all play a role by switching to clean energy sources, reducing waste, and advocating for policies that combat climate change. These actions will protect glaciers, and help stabilize global weather patterns.

A Wake-Up Call

The Sikkim flood wasn’t just a freak event—it was a preview of what’s to come if we don’t act now. The good news? We still have time to prepare. By investing in early warning systems, better infrastructure, and climate solutions, we can reduce the risk of future disasters—both in the Himalayas and here at home.

Source: Sattar, A., Cook, K. L., Rai, S. K., Berthier, E., Allen, S., Rinzin, S., Van Wyk de Vries, M., Haeberli, W., Kushwaha, P., Shugar, D. H., Emmer, A., Haritashya, U. K., Frey, H., Rao, P., Gurudin, K. S. K., Rai, P., Rajak, R., Hossain, F., Huggel, C., … Younis Bhat, S. (2025). The Sikkim flood of October 2023: Drivers, causes, and impacts of a multihazard cascade. Science.