The State of Climate Action 2023 provides the world’s most comprehensive roadmap of how to close the gap in climate action across sectors to limit global warming to 1.5°C. This pivotal report aims to limit global warming to 1.5°C by accelerating efforts across various sectors, emphasizing the urgent need for immediate and scaled-up action.

Understanding the Global Stocktake

Central to the report’s timing is the final phase of the Global Stocktake, a crucial process under the Paris Agreement. The Global Stocktake is a systematic review conducted every five years to assess collective progress toward achieving the goals of the Paris Agreement. This includes evaluating the effectiveness of actions taken to reduce greenhouse gas emissions, adapt to the impacts of climate change, and provide necessary support to developing countries. The outcomes of the Global Stocktake are pivotal in informing and enhancing international climate action, ensuring that the global response to climate change remains on track and is continuously improved upon.

Global Stocktake and the Roadmap Ahead

Published in anticipation of the Global Stocktake’s final phase, the State of Climate Action 2023 report provides actionable insights, translating the Paris Agreement’s 1.5°C temperature limit into tangible 2030 and 2050 targets. These targets encompass sectors responsible for approximately 85% of global greenhouse gas (GHG) emissions, including power, buildings, industry, transport, forests, land, food, agriculture, technological carbon removal, and climate finance.

Assessment of Current Progress

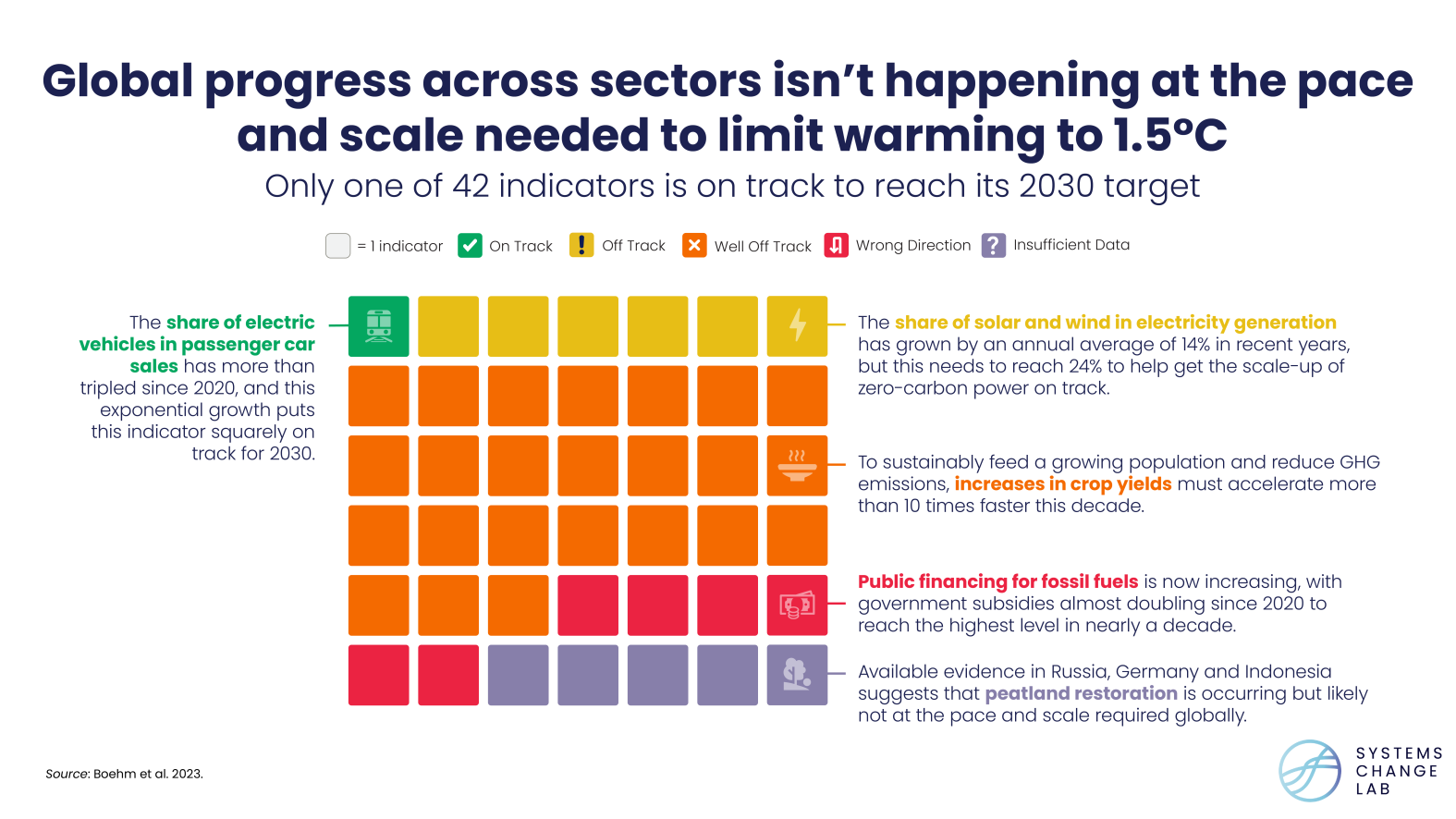

A sobering reality check, the report reveals that the current pace of progress towards 1.5°C-aligned targets is alarmingly inadequate. Except for the sales of electric passenger cars, every other indicator is lagging significantly, underscoring the urgent need for acceleration in climate action.

Key Findings: A Mixed Bag of Progress and Setbacks

The analysis of 42 indicators shows a glaring shortfall in achieving the 2030 targets. More than half of these indicators are far off course, demanding at least a twofold increase in efforts this decade. Particularly concerning are areas such as public financing for fossil fuels, deforestation, and carbon pricing systems, which have regressed significantly.

Bright Spots Amidst Challenges

Despite the grim findings, there are glimmers of hope. The exponential growth in electric vehicle sales over the past five years marks a significant stride towards the 2030 target. Similarly, promising developments in mandatory corporate climate risk disclosure, sales of electric trucks, and the share of EVs in passenger car fleets offer optimism.

The Urgent Need for Accelerated Action

To align with the 2030 targets, drastic escalations are required across all sectors. This includes:

- Increase growth in solar and wind power. The share of these two technologies in electricity generation needs to reach 24 percent, from an annual average of 14 percent, to get on track for 2030.

- A sevenfold acceleration in phasing out coal in electricity generation. This is equivalent to retiring roughly 240 average-sized coal-fired power plants each year through 2030. However, the continued build-out of coal-fired power will increase the number of plants that need to be shuttered in the coming years.

- A sixfold expansion in rapid transit infrastructure coverage. This is equivalent to constructing public transit systems roughly three times the size of New York City’s network of subway rails, bus lanes, and light-rail tracks each year throughout this decade.

- The annual rate of deforestation — equivalent to deforesting 15 football (soccer) fields per minute in 2022 — needs to be reduced fourfold over this decade.

- An eightfold increase in the shift to healthier, more sustainable diets. This involves lowering per capita consumption of meat from cows, goats, and sheep to approximately two servings per week or less across high-consuming regions (the Americas, Europe, and Oceania) by 2030.

Conclusion: An Urgent Call for Transformative Change

The State of Climate Action 2023 Action 2023 serves as a stark reminder of the immense work ahead. With only a single indicator on track for its 2030 target, the report underscores the need for immediate, transformative changes in every sector. This decisive moment calls for governments, corporations, and individuals to embrace systemic changes, ensuring a sustainable future for our planet.